Content

I don’t think there’s anything special you have to do, it comes down to the normal networking tactics – reach out several months in advance, ask for advice about the switch, follow up to check on openings, etc. SomeWhat is capital in accounting • Debt Capitals lateral hires with credit analysis experience at rating agencies or corporate banking join, and you’ll find former industry coverage bankers here as well. Along with being a part of the financial leverage ratios, the debt to equity ratio is also a part of the group of ratios called gearing ratios. Understanding the debt to equity ratio in this way is important to allow the management of a company to understand how to finance the operations of the business firm. A company’s debt is its long-term debt such as loans with a maturity of greater than one year.

- Some teams are divided into corporate vs. government issuers, and then they are further divided into industry verticals.

- Market value is what an investor would pay for one share of the firm’s stock.

- This makes it a relatively risky proposition, as the business is aggressively financing growth activities with debt.

- It’s difficult to pinpoint cost of equity, however, because it’s determined by stakeholders and based on a company’s estimates, historical information, cash flow, and comparisons to similar firms.

- This provides a new and unique view of how the CEO׳s incentives are shaped by not only his compensation contract but also debt contracts.

To calculate the gain in your business accounting records, take the final sale price of the machine ($2,000) and subtract the initial purchase price ($1,500). A capital gain occurs when your investment is worth more than its purchase price. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

How to grow capital

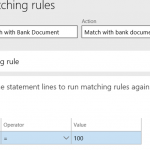

As someone who spent a couple years as a DCM analyst, it should be made clear that you pick up zero modeling skills. At a BB firm, you do a fair amount of acquisition financing analysis but all of the financial analysis will be outsourced to industry team and you will be left with mind-numbing market update.

This authentication occurs automatically, and it is not possible to sign out of an IP authenticated account. We welcome applicants of diverse backgrounds and hire without regard to color, gender, religion, national origin, citizenship, disability, age, sexual orientation, or any other characteristic protected by https://personal-accounting.org/. We celebrate these differences and rely upon your unique perspective to innovate and seize new opportunities. We give people the freedom to take risks, think differently, take ownership of their work, and make great things happen.

Journal of Financial Intermediation

It’s difficult to pinpoint cost of equity, however, because it’s determined by stakeholders and based on a company’s estimates, historical information, cash flow, and comparisons to similar firms. Startups, for example, can have higher debt-to-capital ratios as they work to secure their customer base and increase sales. These companies may be relying on a mix of debt and equity financing to fund operations in the near-term, with the goal of shifting away from debt once they’re more established. Investing in a startup that’s using debt to fund a sizable chunk of its operations can be a gamble if the company doesn’t take off as expected. When there’s less cash flow coming in to pay debt obligations, that increases the risk of default if capital reserves dry up.

What are the 7 types of capital?

The seven community capitals are natural, cultural, human, social, political, financial, and built. Natural Capital includes all natural aspects of community. Assets of clean water, clean air, wildlife, parks, lakes, good soil, landscape – all are examples of natural capital.

Similar to ECM, DCM tends to attract a lot of negative comments online – often from people with zero experience in the finance industry. But if you want to make a long-term career out of banking, DCM is a good option since you’ll have a better lifestyle and you’ll still earn a lot. Some argue that DCM offers better long-term career prospects than ECM because it’s “more stable” and bankers are less likely to be cut in downturns.