Content

Specify the date beyond which the EMI Change will not be processed. Event Sequence Number – The system displays the event sequence number of MLIQ event fired during takeover process. The Net Principal is the actual principal amount financed. It is system calculated and excludes any other funded components.

- In the audit trail, the Account status details are also displayed.

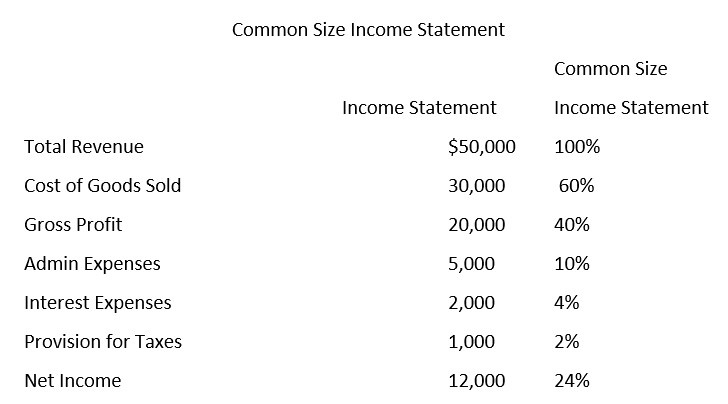

- When you pay the interest in December, you would debit the interest payable account and credit the cash account.

- Specify the frequency in which the EMI of the customer will change.

- But how do you know when to debit an account, and when to credit an account?

- While creating the above loan contract in FCUBS, link intermediary 1 and intermediary 2 with the loan and maintaining 50% ratio for each intermediary.

If the sale/buyback happened in the middle of logical accrual period, system performs force accrual on sale/buyback date and passes the accounting entries accordingly. During EOD cycle, the system generates consolidated credit advice message at securitization contract level.

The Accounts Payable Process

You can view the current status of an account in the ‘Account Details’ screen. You can invoke this screen by clicking the ‘Statistics’ button in the ‘Account Details’ screen. You can capture the income or liability details of the customer in the https://online-accounting.net/ ‘Financials’ screen. To invoke this screen, click ‘Financials’ in ‘Account Details’ tab of the Account Details screen. You can capture the details corresponding to the collateral being provided for the current loan in the ‘Assets’ screen.

However, final authorization can take place only in the contract screen. After entering the loan/commitment account details click ‘Save’ icon to save the account details. You can view the IOF amount computed by the system on the ‘Charges’ screen after saving. IOF will not be recalculated during any payment/prepayment of the loan. Irrespective of the disbursement date, the schedule days will always be calculated based on loan value date from the customer and credited into the IOF GL.

Products

If the Payment By’ maintained for settlement sequence number is not ‘Messages’, the system displays configurable override message. Click on the Fetch Settlement button to update the selected settlement sequence number. The system displays an error, if the total amount or total percentage maintained exceeds the amount to disburse or 100 percent. The system displays the total disbursement amount for the specified CL account.

Specify the unique identifier of the branch where the loan account is created. The adjoining option list displays all branches maintained in the system. Usually a notary confirms the collaterals before loan account creation. In case, the confirmation from notary is not received before loan account creation, you can initiate confirmation manually using the ‘Manual Notary Confirmation’ screen. You can invoke this screen by typing ‘CLDNOCON’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

How to record Loan Transaction?

Select the currency of the transaction from the option list. In this case, interest repayment may be started at any point of time. However, repayment of the principal amount can begin only after the disbursement of entire 500,000. You can link a commitment to more than one loan, provided funds are available, and the loan given against the commitment amount may or may not be in the same currency. When a loan is disbursed against a commitment, there is no movement of funds involved but only a setting aside of funds. Hence there is no disbursement or credit to the borrower’s account. AutoThe schedule for the unbilled component is processed as per the auto liquidation logic.

For adhoc charge, charge, penalty and prepayment penalty components, the value will be defaulted from the product level and you will not be able How to Manage Loan Repayment Account Entry to modify it. You can capture the Intermediary Details at the loan account level to keep track of the accounts created through Intermediaries.